The Effect of Service Quality on Customer Loyalty with Corporate Image as A Mediation Variable at BNI Bank Bekasi Branch Office

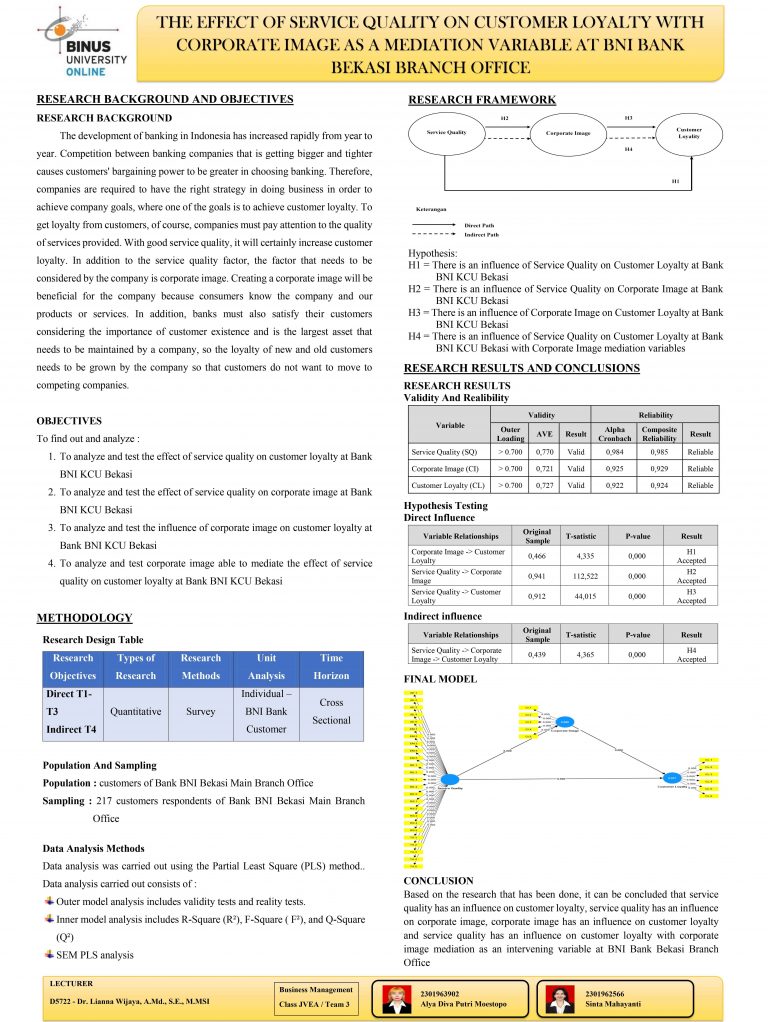

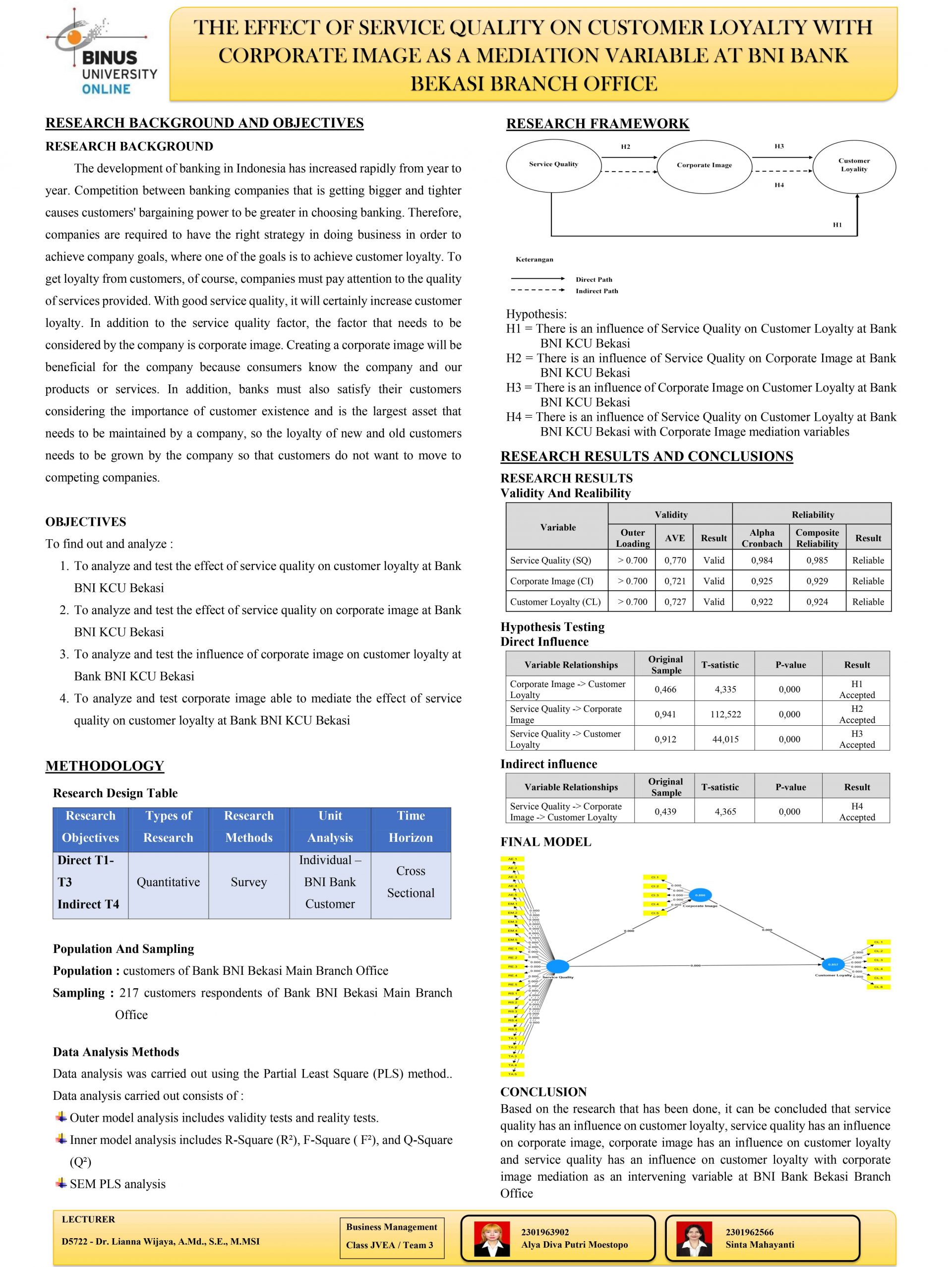

The investigation delves into the evolution of the banking sector in Indonesia, a country that has witnessed a steady rise in competitive forces year by year. This escalating level of competition underscores the imperative for banks to carefully devise and implement effective strategies that will not only draw in customers but also ensure their retention over time. An essential element that directly impacts customer loyalty is the caliber of service that the bank provides. Furthermore, the overall corporate image of the bank holds considerable sway, as it shapes the perceptions and levels of trust that customers harbor towards the institution. Through a dual focus on maintaining superior service quality and cultivating a robust corporate image, banks can fortify customer loyalty, effectively thwarting any inclination on the part of customers to defect to rival institutions.

Promote development-oriented policies that support productive activities, decent job creation, entrepreneurship, creativity, and innovation, and encourage the formalization and growth of micro-, small- and medium-sized enterprises, including through access to financial services. Increase the access of small-scale industrial and other enterprises to financial services, including affordable credit, and their integration into value chains and markets.

Keywords:

SDG 8 (Economic Growth), SDG 9(Industrial Growth)